Build Credit with Rent: The Complete Guide to Rent Reporting and Credit Monitoring

Build Credit with Rent: The Complete Guide to Rent Reporting and Credit Monitoring

Build Credit with Rent: The Complete Guide to Rent Reporting and Credit Monitoring

What is ACH Payment Processing and How Does it Work?

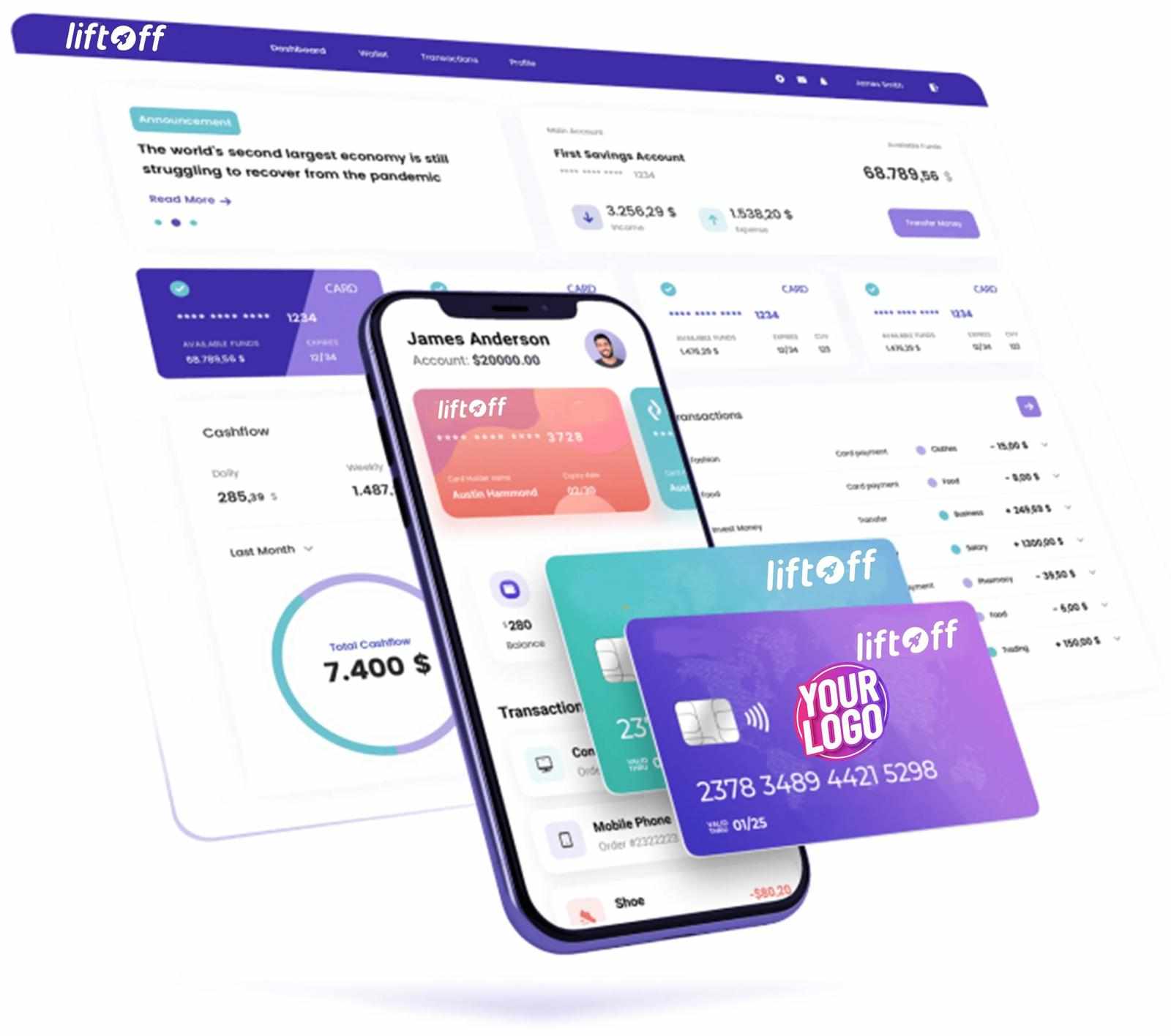

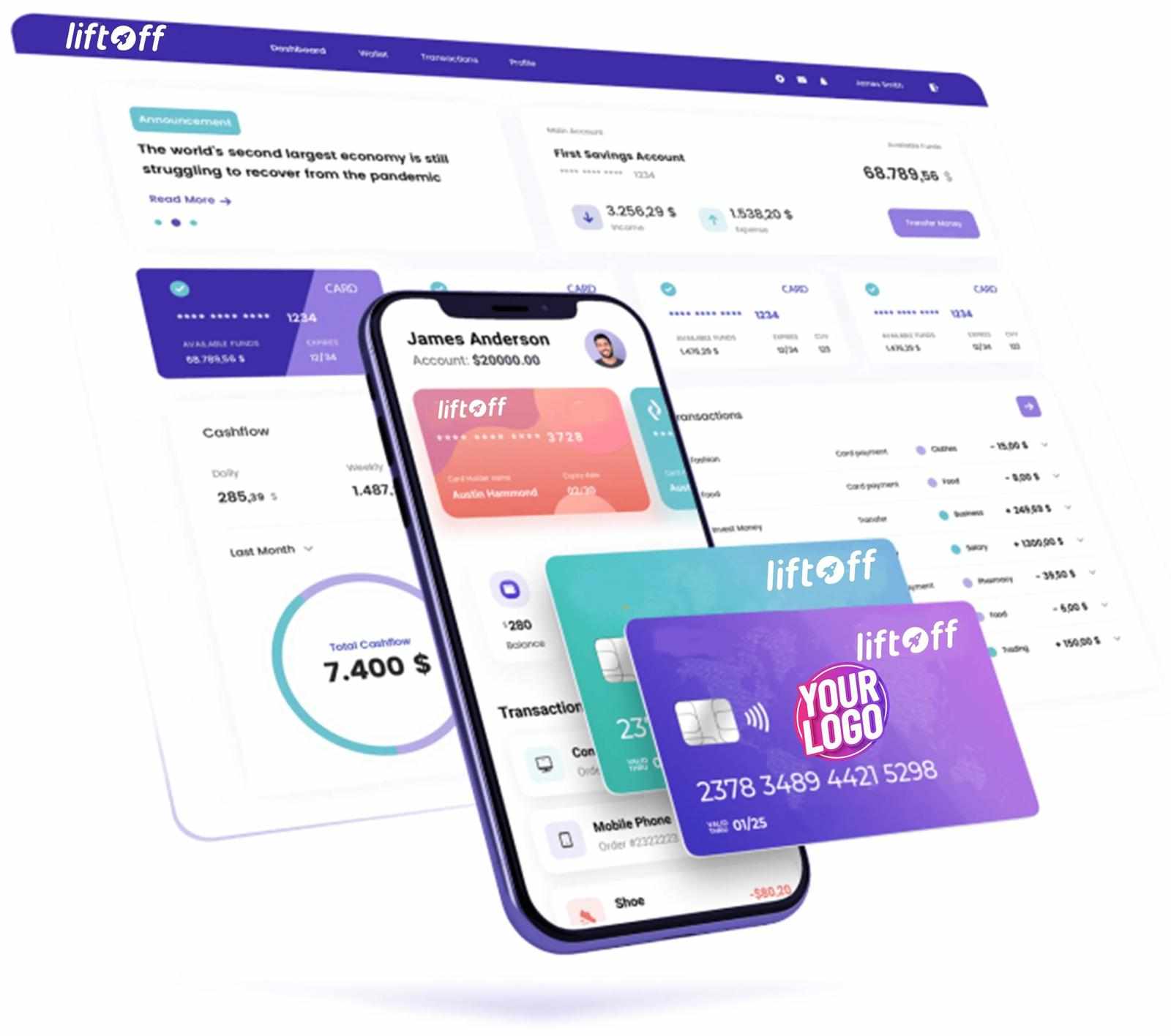

As more people seek to boost their credit scores, protect their identities, and make smarter financial moves, leveraging technology is the key to success. Liftoff Platform, a cutting-edge payment solution provider, is helping consumers and businesses unlock new financial possibilities. Here’s how Liftoff can empower you in four crucial areas: rent reporting, credit building, identity protection, and credit improvement.

With the rise of real time payments and same day ACH payments, instant money transfers are becoming the new normal for payroll, refunds, business payouts, and even government disbursements. Businesses, individuals, and agencies are moving away from slow, traditional transfers in favor of faster, more efficient systems.

In today's fast-paced digital economy, access to financial tools is essential for personal and business growth. Whether you're a startup needing instant issue debit cards, a small business looking for credit builder programs, or a consumer seeking the best credit monitoring services, understanding your options is key.

ACH Payment Processing for Businesses: Why Businesses Choose ACH

In today’s financial world, a strong credit score isn’t just a number—it’s your gateway to better interest rates, easier loan approvals, and more financial freedom. Whether you're an individual looking to establish personal credit or a small business owner aiming to build business credit, this guide will walk you through the essential steps, including how ACH processing services and loans to build credit can help you achieve your financial goals.