In today's fast-paced digital economy, access to financial tools is essential for personal and business growth. Whether you're a startup needing instant issue debit cards, a small business looking for credit builder programs, or a consumer seeking the best credit monitoring services, understanding your options is key.

This guide will walk you through three critical services: card issuance, credit building, and credit monitoring—all optimized for financial health and business success.

🔹 Card Issuance: What It Is and Why It Matters

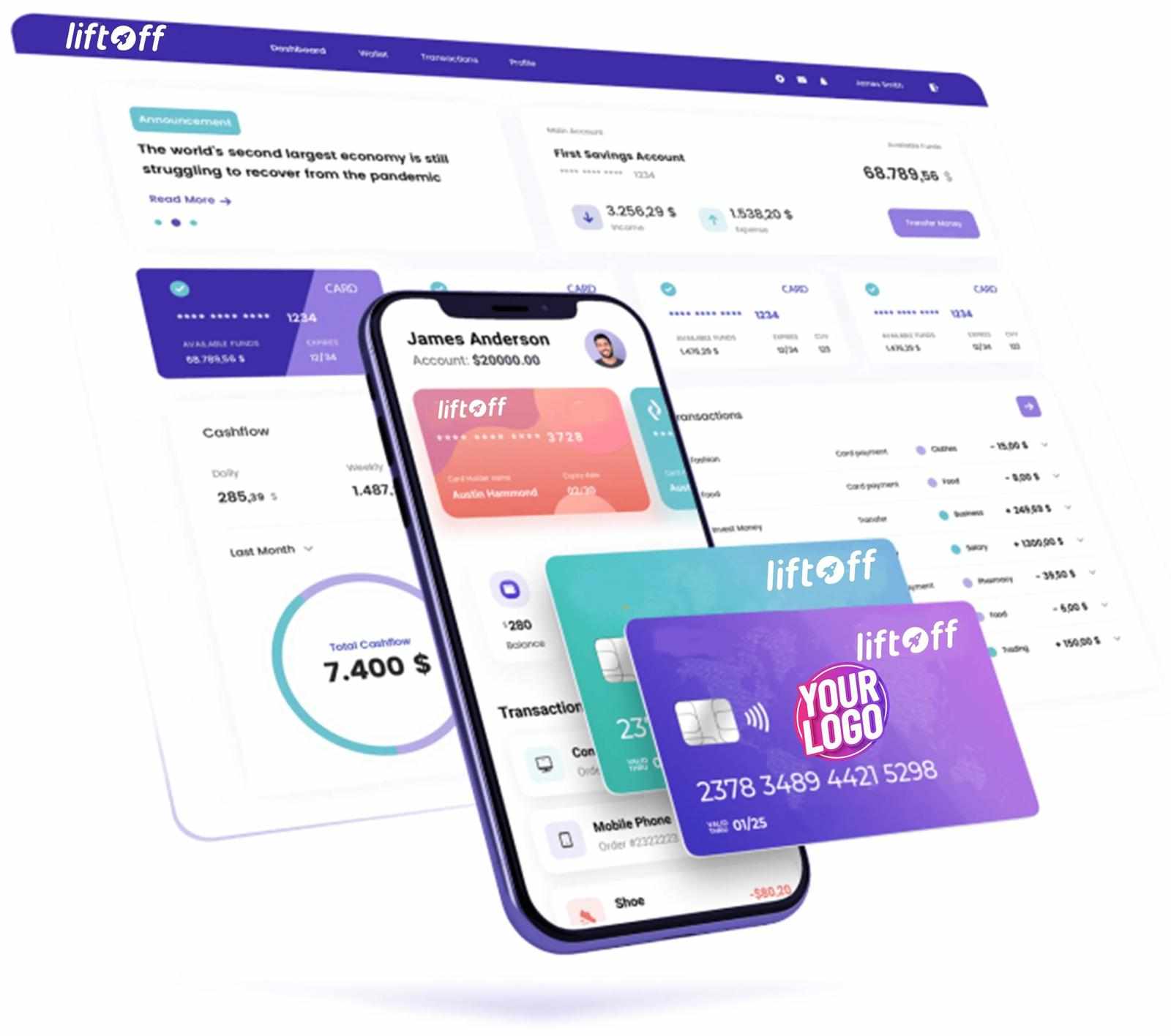

Card issuance is the process by which banks, fintech companies, or financial institutions issue debit or credit cards to individuals or businesses. Today, with fintech innovation, you no longer need to wait weeks to receive your card. Thanks to instant issue credit cards and instant issue debit cards, users can access funds faster than ever before.

✅ Types of Card Issuing Services

Debit Card Issuing: Perfect for businesses managing payroll, vendor payments, or expense tracking.

Credit Card Issuing: Ideal for consumers and business owners seeking purchasing power and rewards.

Instant Issue Card Services: These enable cardholders to receive and activate their cards immediately at a branch or via digital wallets.

💼 Who Uses Card Issuance Services?

Banks and Credit Unions

Fintech Startups

Corporate Expense Management Platforms

Payment Service Providers

🌟 Benefits of Card Issuance

Reduced wait time with instant card delivery

Custom branding for corporate cards

Integrated fraud protection and real-time transaction monitoring

🔹 Business Credit Building Companies: What They Do

Establishing and maintaining business credit is essential for long-term financial success. Business credit building companies help entrepreneurs and small businesses access tools and strategies to grow their credit profiles.

✅ Key Credit Building Services

Credit Builder for Business: Establish a business credit profile separate from your personal credit.

Credit Builder Programs: Monthly payment plans or secured cards that report to commercial credit bureaus.

Loans to Build Credit: Special microloans or instalment plans that help you build payment history.

🚀 Why Use Credit Builder Services?

Secure better interest rates and loan approvals

Increase your chances of vendor and supplier financing

Separate your personal and business financial responsibilities

📈 How to Build Credit for a Business

1. Register your business and get an EIN

2. Open a business bank account

3. Use vendor tradelines that report to credit bureaus

4. Apply for a credit builder program

5. Monitor your business credit reports monthly

🔹 Best Credit Monitoring Services in 2025

With identity theft and data breaches on the rise, credit monitoring services are no longer optional—they're essential. These tools track your credit activity and alert you to suspicious behavior or changes in your credit report.

✅ Features of the Best Credit Monitoring Service

24/7 credit monitoring across all major bureaus (Equifax, Experian, TransUnion)

Real-time fraud alerts

Identity theft insurance

Score tracking and credit improvement tips

🏆 Top Credit Monitoring Companies

Identity Guard

LifeLock

Credit Karma

Experian CreditWorks

MyFICO

💡 Why Credit Monitoring Is Important

Detect identity theft early

Protect your credit score

Ensure accuracy in your credit report

Get notified about major changes, such as new loans or inquiries

🔹 Final Thoughts

Whether you're managing a startup, improving your financial literacy, or protecting your identity, choosing the right services can set you up for long-term success.

Explore card issuing services, enroll in a credit builder program, and protect your future with the best credit monitoring services available today. With the right tools, you’ll unlock better financial opportunities, faster funding, and peace of mind.

Write a comment ...